Market Position

With its listed core business Port Logistics, HHLA operates on the European market for international sea freight services. This continues to offer attractive long-term growth prospects, as the competitiveness achieved by key Central European countries in a global context provides the basis for further growth in trade volumes and consumption potential going forward. The ability to leverage the potential offered by the Eastern European markets, particularly the Russian Federation and Ukraine, is largely dependent on finding political solutions to existing regional conflicts as well as a return to more normal commodity and energy prices.

The relevant economic indicators point to a continued stabilisation of GDP growth in the eurozone. In view of the persistently high level of debt in the region, however, stronger growth is only expected in the medium to long term. For the short and medium term, on the other hand, there are indications of a fundamental reassessment of expected growth in containerised trade and transport volumes. This is primarily due to exogenous conditions and structural problems or crises, for which compelling solutions are still outstanding.

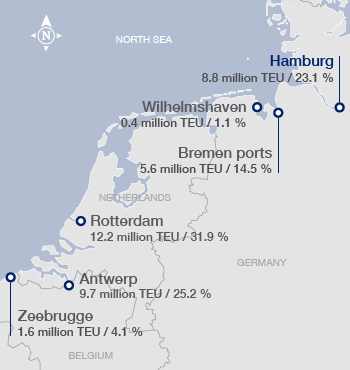

Throughput at the North Range Ports

Volumes and market shares, 2015

Source: Port Authorities / own calculation (market share)

The market for port services on the Northern European coastline (the North Range) of relevance for HHLA is characterised by its high concentration of ports. Competition is currently strongest between the major North Range ports of Hamburg, HHLA’s main hub, the Bremen ports, Rotterdam and Antwerp. Other handling sites – such as Wilhelmshaven, Le Havre and Zeebrugge – are considerably smaller in terms of their capacity and/or current freight volume. At present, the Baltic Sea ports are primarily served by feeder traffic operating via central distribution points in the North Range. Overseas services calling directly at ports, such as Gdansk (Poland) or Gothenburg (Sweden), are increasingly competing with this network system.

As well as the geographical position and hinterland links of a port, its accessibility from the sea affects the competitive position of terminal operators and thus local freight volumes. Other key competitive factors that influence market position include pricing, the reliability and speed of ship handling, the scope and quality of container handling services, as well as the performance of pre- and onward-carriage rail systems serving the hinterland (e.g. frequency, punctuality, pricing).

Container Throughput at the largest North Range Ports

in TEU million

Source: Port Authorities; *incl. HHLA

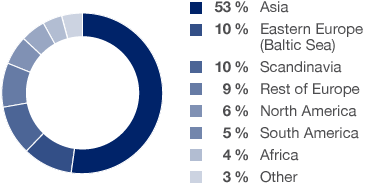

Seaborne Container Throughput by Shipping Region

in the Port of Hamburg, 2015

Source: Hamburg Hafen Marketing e.V.

Two additional container terminals in Rotterdam (Maasvlakte 2) officially commenced operations in spring and autumn 2015. This led to a significant increase in capacity on the market and fiercer competition, especially for freight volume with greater geographical flexibility such as feeder traffic. In contrast to this, the market position for handling volumes which are tied to the natural catchment area onshore is largely stable – given that it is vital to take the shortest route for the disproportionately more expensive land-bound transportation.

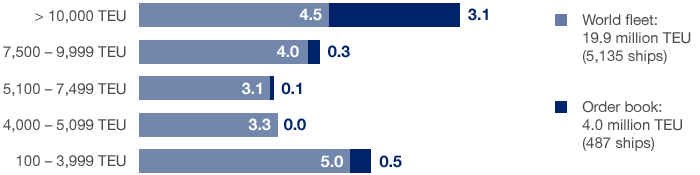

The market research institute AXS Alphaliner estimates that the carrying capacity of the global container ship fleet increased by 8.5 % to 19.9 million TEU in 2015. The number of ultra large vessels with a capacity of more than 10,000 TEU increased particularly strongly, with growth of 27.2 % to 337. This means that some 45 % of the ships delivered in 2015 can carry in excess of 10,000 TEU.

Current World Fleet and Order Book until 2019

by vessel size categories in TEU million

Source: AXS Alphaliner

The Container segment benefits from the Port of Hamburg’s position as the most easterly North Sea port, which makes it the ideal hub for the entire Baltic region and for hinterland traffic to and from Central and Eastern Europe. Furthermore, the long-standing trading relationships between the Port of Hamburg and the Asian markets are advancing Hamburg’s role as an important European container hub. With a throughput of 8.8 million TEU, Hamburg ranked an estimated 19th among the world’s leading international ports in 2015 and is currently the third-largest European container port after Rotterdam and Antwerp.

In Hamburg, HHLA maintained its position as the largest container handling company with a throughput volume of 6.4 million TEU in 2015. 73 % of container traffic (previous year: 75 %) at the Port of Hamburg was handled by HHLA. Asia, Eastern Europe and Scandinavia remained the most shipping regions.

In the Intermodal segment, HHLA primarily utilises the advantages of the Port of Hamburg’s rail infrastructure – Europe’s most important rail traffic hub handling more than 2 million TEU a year. HHLA’s Intermodal network also comprises further ports along the North Sea and Baltic Sea coasts as well as the northern Adriatic and increasingly, continental traffic. The companies which transport containers by train compete with other rail operators and intermodal transport firms in Germany and abroad, but also with other carriers such as trucks and feeder ships. As the rail infrastructure is for the most part publicly owned, various national authorities guard against discrimination in both access and usage fees. In addition to the density of the available network, key competitive factors include the frequency of departures, opportunities for freight pooling and storage in the hinterland, the geographical distance to destinations, on-schedule operation and infrastructural capacity. The importance of these factors is growing as ports compete with one another.

Intermodal Network of HHLA

Selected connections

HHLA has proprietary inland terminals in Central and Eastern Europe along with its own container wagons and traction (locomotives). All of these factors play a major role in the company’s service offer. This is necessary to enable it to run direct trains with frequent departures and to allow the efficient pooling of rail freight transported via the port which is efficiently distributed by central handling facilities. HHLA occupies relevant market positions in the majority of the regions it serves. HHLA has a sound market position in the greater Hamburg metropolitan region in the delivery and collection of containers by truck.

The Logistics segment serves various market sectors, some of them heavily specialised. With its multi-function terminal, HHLA is the leading provider of specialist handling services in Hamburg. Via Hansaport, HHLA has a stake in Germany’s biggest seaport terminal for handling iron ore and coal. HHLA also provides fruit handling services for Northern Europe with its Frucht- und Kühl-Zentrum. HHLA’s complementary range of warehouse and contract logistics services supports the Group’s market positions in the handling and transportation sectors. In the field of consultancy, work is conducted on pioneering development projects around the world.

With a population of around 1.8 million and its significance as an economic centre, Hamburg is one of the largest and most interesting property markets in Germany for the Real Estate segment. The Real Estate segment owes its outstanding market position to the special attractiveness of the properties it manages in Hamburg’s Speicherstadt historical warehouse district and on the northern banks of the river Elbe, as well as their customer-specific and sustainable enhancement. The segment competes with German and international investors marketing high-quality properties in comparable locations.

North European coast where in the broadest sense all large continental ports from Le Havre to Hamburg are situated. Among the four largest ports are Hamburg, Bremen ports, Rotterdam and Antwerp.

Vessels that carry smaller numbers of containers to ports. Feeders are used to transport boxes from Hamburg to the Baltic region, for instance.

Describes a port’s catchment area.

Transportation via several modes of transport (water, rail, road) combining the specific advantages of the respective carriers.

Describes a port’s catchment area.

The action of a locomotive pulling a train.