The HHLA Share

in €, Class A shares, Xetra |

2016 |

2015 |

||||

|

||||||

Closing price |

17.70 |

14.06 |

||||

Performance in % |

25.9 |

- 18.5 |

||||

Highest price |

17.88 |

21.37 |

||||

Lowest price |

11.95 |

12.79 |

||||

Average daily trading volume |

43,143 |

68,040 |

||||

Dividend per Class A share1 |

0.59 |

0.59 |

||||

Dividend yield as of 31.12. in % |

3.3 |

4.2 |

||||

Number of listed Class A shares in thousand |

70,048.8 |

70,048.8 |

||||

Market capitalisation as of 31.12. in € million |

1,239.9 |

984.9 |

||||

Price-earnings-ratio as of 31.12. |

19.5 |

16.7 |

||||

Earnings per share |

0.91 |

0.84 |

||||

Stock Markets Up in 2016 with Strong Year-End

Following a weak start, the German leading indices enjoyed modest growth over the course of 2016 and closed the year with a clear gain after a strong year-end rally. However, growth was less dynamic than in the previous year. The stock markets got off to a very weak start in 2016, with the DAX recording its worst opening months for 25 years. These marked losses were caused by the further slide in oil prices and weak economic data from China. As a consequence, the DAX fell to its year-low of 8,753 points in mid-February. However, the continuation of the European Central Bank’s (ECB) expansionary monetary policy and recovered oil prices helped the DAX regain stability. By mid-April, the leading index was able to return to its year-opening level and stabilise at around 10,000 points. The index was buoyed by the weak euro exchange rate and a moderate rise in oil prices at the end of May. However, these gains were lost again amid nervous trading in the run-up to the Brexit vote in June. The United Kingdom’s decision to leave the European Union surprised the financial markets and had a negative impact on share prices. As a result, the DAX tumbled to 9,269 points. In July, share prices were driven up by positive economic data from the USA and the ECB’s ongoing low-interest policy. They remained volatile, however. The DAX largely moved sideways from mid-August onwards. Despite a fundamentally positive economic trend, the markets seemed to lack the necessary momentum and consequently displayed little change. As the US presidential election approached, the markets were initially cautious. Catch-up effects following the victory of the Republican candidate prompted strong gains in the indices. The Dow Jones reached a new all-time-high in November, which also had a positive effect on Germany’s leading indices. The DAX recorded growth of approximately 4 % within the space of two weeks. Stock market prices continued to rally in December, lifting the DAX to a year-high of 11,481 points at close of trading on 31 December 2016 – corresponding to year-on-year growth of 6.9 %. The SDAX stood at 9,519 points on the reporting date, up 4.6 %.

Share Price Development 2016

Source: Datastream

HHLA Share Price Rises by Approximately 26 %

Although the HHLA share had stabilised at around € 14 towards the end of 2015, it was unable to escape negative market sentiment and lost considerable ground at the beginning of the year. Although the preliminary figures published in early February met with a positive market response overall, they were unable to halt the downwards trend. The share consequently reached a new all-time-low of € 11.95 in mid-February but regained this lost ground during the subsequent market recovery. Nevertheless, the share price remained volatile and fluctuated strongly between € 13 and € 14. As the annual results for 2015 published at the end of March were in line with market expectations, they had no impact on the share’s performance. It took until mid-May, when the figures for the first quarter of 2016 were published, for the HHLA share to break through the € 14 mark again, outperforming the market over the remaining weeks of the month. In the first half of June, however, the HHLA share was affected by increasingly tense market sentiment. In this environment, the announcement that there would be a hearing at the Federal Administrative Court in Leipzig regarding the dredging of the river Elbe in December 2016 failed to maintain the share price. The downwards trend was halted temporarily in the run-up to the Annual General Meeting on 16 June 2016. However, the usual ex-dividend markdown took the share price to € 13.38 the next day. Following a brief period of stability, the HHLA share was unable to withstand negative market forces and dipped below the € 13 mark again. In July, the share price was primarily driven by the recovering markets and had stabilised at € 14.50 by mid-August. The price subsequently developed largely in line with the indices until mid-September. Amid the general downwards trend, the share fell below € 14 again. It took until the end of September for the price to bottom out at a closing price of € 13.54. The share price had caught up with the index trend by mid-October and was quoted at between € 14.50 and € 15 until early November. Uncertainty surrounding the outcome of the US presidential election exerted increasingly downward pressure on the benchmark indices, and to some extent on the HHLA share price. Amid positive post-election sentiment, the HHLA share was further buoyed by upgraded and more specific guidance for the 2016 financial year announced on 10 November together with the figures for the first nine months. The forthcoming hearing at the Federal Administrative Court also reawakened investor interest in HHLA, enabling the share to easily outperform the benchmark indices during the course of December. The HHLA share reached its year-high of € 17.88 one day before year-end and closed at € 17.70 on 30 December 2016. The HHLA share therefore gained 25.9 % year-on-year.

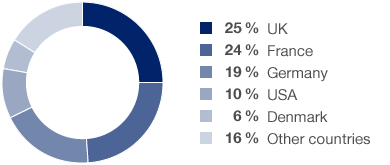

Shareholder Base Still Widely Spread

HHLA’s shareholder base remained largely stable in 2016. In terms of the listed Class A shares, the Free and Hanseatic City of Hamburg remained the company’s largest shareholder with an unchanged stake of 68.4 %. The free float portion amounted to 31.6 %. According to the voting rights notifications submitted to HHLA as of the end of 2016, the US investor First Eagle Investment Management LLC owned 5.2 % of free floating shares, pushing it above the statutory reporting thresholds. The proportion of daily traded shares attributable to retail investors was nearly unchanged from the previous year: 8.7 % of the share capital was held by private investors at the end of the year (previous year: 8.8 %). By contrast, institutional investors continued to hold the majority of free floating shares, with 22.9 % of all shares (previous year: 22.8 %). Overall, HHLA’s share capital remained widely distributed among some 28,500 registered shareholders. In regional terms, the largest free float shareholders were based primarily in Germany, the USA, the UK and mainly other countries in continental Europe.

Type of shares |

No-par-value registered shares |

|

ISIN / SIC |

DE000A0S8488 / A0S848 |

|

Symbol |

HHFA |

|

Stock exchanges |

Frankfurt am Main, Hamburg |

|

Segment |

Prime Standard |

|

Sector |

Transport & Logistics |

|

Index affiliation |

SDAX |

|

Ticker symbol Bloomberg / Reuters |

HHFA:GR / HHFGn.de |

Dialogue with Capital Market Maintained

Rapid reaction times, an ability to provide comprehensive information and an open dialogue with financial analysts and investors remained key to HHLA’s investor relations (IR) activities in 2016, given the persistently volatile industry environment. In order to serve the needs of both institutional and private investors, HHLA attended a number of investor conferences in the key financial cities of Frankfurt, London and New York as well as various private investor events in Germany. These initiatives were supplemented by roadshows in London and Paris. Investors were also invited to a large number of meetings at the company’s headquarters in Hamburg. The information on offer and discussion opportunities met with considerable interest. Furthermore, the Executive Board provided details on business developments during quarterly conference calls.

Coverage of IR Activities

in 2016 by region

With its proactive approach to communications, the Investor Relations department maintains a close dialogue with shareholders and potential investors. In addition to informing interested members of the public, the IR team also responds to issues of particular relevance to investors. In the 2016 financial year, HHLA’s investors were particularly interested in the current status of proceedings regarding the dredging of the river Elbe and the various possible verdicts. Numerous enquiries were also made into cost-cutting potential and how the economic slowdown and negative growth in China and Russia would affect business developments at HHLA. The formation of new shipping alliances and the consequences for both capacity utilisation at HHLA and the company’s negotiating position were also discussed at length.

HHLA has been offering a full HTML version of its Annual Report in addition to existing services such as the IR website and Twitter updates since 2016. The switch from print to online enables all stakeholders to navigate information interactively, search for content in a targeted manner and compile this information as desired. The 2015 Annual Report received Gold in the FOX Finance Awards, with the jury praising in particular its transparency and usability.

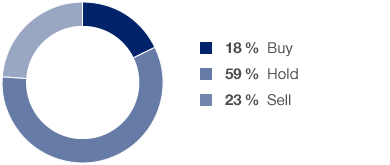

HHLA Share Still of Interest for Analysts

Recommendation by Financial Analysts

as of 31.12.2016

The number of analysts covering HHLA’s business development and issuing research reports and recommendations fell to 17 in the course of the year. This means that the HHLA share still has above-average coverage for an SDAX company. Approximately three quarters of analysts recommend the HHLA share as a buy or a hold, citing the Intermodal business in particular as well as the growth potential of dredging the navigation channel as possible value drivers. Analysts with a sell recommendation mainly emphasise the increasingly intense competition among North Range ports, limited cost flexibility and the risks associated with the continued delay in the dredging of the river Elbe.

HHLA places great value on broad and well-informed coverage of its share by financial analysts as this enhances investors’ understanding of the company’s business model and ensures a comprehensive range of sentiments. HHLA therefore remains in close contact with all financial analysts and constantly strives to expand the number of independent studies conducted.

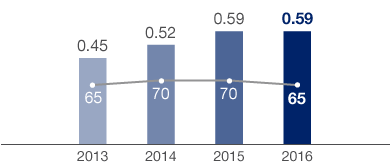

Payout Ratio at a High Level

Development of Dividend and Payout Ratio

per listed Class A share in € / payout ratio in %

2016: Dividend proposal

The ninth Annual General Meeting since HHLA’s initial public offering in 2007 was held in Hamburg on 16 June 2016. Approximately 850 shareholders or 84 % of the nominal capital were represented (previous year: 83 %). The resolutions proposed by the Supervisory Board and the Executive Board were all adopted by the shareholders present with large majorities. These included a motion to distribute a dividend of € 0.59 per entitled share of the listed Port Logistics subgroup (Class A share). HHLA therefore distributed dividends totalling € 41.3 million (previous year: € 36.4 million). This corresponded to a payout ratio of approximately 70 % of the Port Logistics subgroup’s net profit after minority interests for the year. The dividends were paid out to the shareholders on 17 June 2016. Based on its closing price of € 13.65 on the day of the Annual General Meeting, the HHLA share achieved a dividend yield of 4.3 %, putting it in the top ten of the SDAX.

On the basis of the earnings achieved in 2016, the Executive Board and Supervisory Board will propose a dividend of € 0.59 per Class A share at the Annual General Meeting to be held on 21 June 2017. A total of € 41.3 million would therefore be distributed, as in the previous year. In an external comparison, the payout ratio would remain high at 65 %. HHLA would therefore continue to pursue its dividend policy of distributing between 50 and 70 % of the Port Logistics subgroup’s relevant net profit for the year to its shareholders.

Payments for investments in property, plant and equipment, investment property and intangible assets.

Transportation via several modes of transport (water, rail, road) combining the specific advantages of the respective carriers.

The North European coast. In the broadest geographic sense, this is where all the international ports in Northern Europe from Le Havre to Hamburg can be found. The four largest ports are Hamburg, Bremerhaven, Rotterdam and Antwerp.