Container Segment

in € million |

2016 |

2015 |

Change |

|||

Revenue |

694.6 |

675.2 |

2.9 % |

|||

EBITDA |

201.5 |

195.8 |

2.9 % |

|||

EBITDA margin in % |

29.0 |

29.0 |

0.0 pp |

|||

EBIT |

117.8 |

110.6 |

6.5 % |

|||

EBIT margin in % |

17.0 |

16.4 |

0.6 pp |

|||

Container throughput in thousand TEU |

6,658 |

6,561 |

1.5 % |

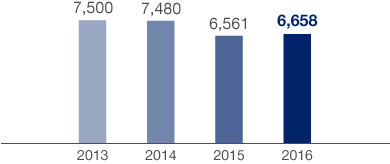

HHLA’s container terminals handled 6,658 thousand TEU in the 2016 financial year, 1.5 % more than in the previous year (6,561 thousand TEU). Although the negative trend of the previous year initially continued in the first two quarters, throughput volumes picked up again in second half of the year. Whereas container throughput rose slightly by 1.1 % to 6,375 thousand TEU at HHLA’s three container terminals (previous year: 6,305 thousand TEU), there was significant growth in container throughput at the Container Terminal Odessa of 10.6 % to 283 thousand TEU (previous year: 256 thousand TEU).

Development in Container Throughput

in thousand TEU

The volume trend at the Hamburg terminals was primarily due to growth in feeder traffic with the Baltic sea ports, which picked up significantly in the second half of the year and rose by approximately 6 % year-on-year. Traffic to and from Russia in particular recovered strongly with year-on-year growth of around 15 %. As a consequence, the proportion of seaborne handling accounted for by feeders increased to 24.0 % in 2016 (previous year: 22.9 %). The decline in Asian routes (Far East–Northern Europe) slowed significantly compared with the previous year. However, container volumes to and from the Far East were still down almost 2 % year-on-year in 2016.

Despite an extremely dynamic volume trend at the Ukrainian ports, competition continued to intensify in 2016 as a result of existing overcapacities. After capturing significant market share in the previous year, the HHLA Container Terminal Odessa (CTO) lost ground in 2016 as its growth was slower than the market as a whole. Nevertheless, CTO still enjoys a dominant position in the regional market.

Revenue rose by 2.9 % year-on-year to € 694.6 million (previous year: € 675.2 million), faster than seaborne volumes. In addition to contractually agreed adjustments to individual handling rates, higher storage fees led to an increase in revenue per unit. Revenue per container handled at the quayside rose by 1.4 % year-on-year.

The segment’s EBIT costs increased by 2.2 %, and thus slightly faster than seaborne handling volumes. The increase in personnel expenses was mainly due to higher union wage rates, as well as fluctuations in the utilisation of capacity at the facilities. In the second half of 2016 in particular, higher throughput was concentrated on fewer ship calls and thus required the increased use of external staff to handle peak loads. By contrast, material costs were reduced compared to 2015, supported above all by lower fuel prices. Targeted cost-cutting measures also helped reduce maintenance costs. All in all, these factors led to a 6.5 % increase in the operating result (EBIT) to € 117.8 million (previous year: € 110.6 million). There was a corresponding rise in the EBIT margin to 17.0 % (previous year: 16.4 %).

In view of the impending reorganisation of service structures with the new “OCEAN ALLIANCE” and “THE Alliance” consortia as of April 2017, as well as further new ship deliveries, the number of ultra large container ships calling at Hamburg is likely to increase further. HHLA is well prepared for this development and continued to drive the upgrades to its facilities in the reporting period. In late 2016, for example, three additional container gantry cranes for handling the largest container ships were delivered to the Container Terminal Burchardkai (CTB) and will be gradually put into operation in spring 2017. The addition of four automated blocks to the block storage facility is also due to be completed in the second quarter of 2017. In addition, the Container Terminal Tollerort (CTT) took delivery of two container gantry cranes to handle the latest generation of ships in early 2017. A further three have been ordered and are expected in late 2017.

In maritime logistics, a terminal is a facility where freight transported by various modes of transport is handled.

A TEU is a 20-foot standard container, used as a unit for measuring container volumes. A 20-foot standard container is 6.06 metres long, 2.44 metres wide and 2.59 metres high.

A TEU is a 20-foot standard container, used as a unit for measuring container volumes. A 20-foot standard container is 6.06 metres long, 2.44 metres wide and 2.59 metres high.

In maritime logistics, a terminal is a facility where freight transported by various modes of transport is handled.

Vessels which carry smaller numbers of containers to ports. From Hamburg, feeders are primarily used to transport boxes to the Baltic region.

Revenue from sales or lettings and from services rendered, less sales deductions and VAT.

Earnings before interest and taxes.

A crane system used to load and discharge container ships. As ships are becoming larger and larger, the latest container gantry cranes have much higher, longer jibs to match.

Automated block storage is used at the HHLA Container Terminals Altenwerder and Burchardkai to stack containers in a compact and efficient manner. Containers are stacked in several storage blocks. Rail-mounted gantry cranes are used to transport and stow the boxes.