Financial Position

Balance Sheet Analysis

Compared with the previous year, the HHLA Group’s balance sheet total increased by a total of € 62.5 million to € 1,812.9 million as of 31 December 2016.

in € million |

31.12.2016 |

31.12.2015 |

||

Assets |

|

|

||

Non-current assets |

1,329.0 |

1,305.8 |

||

Current assets |

483.9 |

444.6 |

||

|

1,812.9 |

1,750.4 |

||

|

|

|

||

Equity and liabilities |

|

|

||

Equity |

570.8 |

580.6 |

||

Non-current liabilities |

1,028.1 |

979.2 |

||

Current liabilities |

214.0 |

190.6 |

||

|

1,812.9 |

1,750.4 |

On the assets side of the balance sheet, non-current assets rose by € 23.2 million. This increase is largely attributable to the € 21.3 million rise in deferred taxes to € 82.7 million (previous year: € 61.4 million), due mainly to the interest rate-related change in actuarial gains and losses on pension obligations. Capital expenditure led to an increase in property, plant and equipment of € 3.8 million to € 950.9 million (previous year: € 947.1 million), while investment property declined by € 6.6 million to € 184.0 million due to scheduled depreciation.

Current assets rose by € 39.3 million to € 483.9 million (previous year: € 444.6 million). The increase was mainly due to growth in trade receivables of € 32.3 million to € 160.4 million (previous year: € 128.1 million) and receivables from related parties, which rose by € 23.2 million to € 81.7 million (previous year: € 58.5 million) as the result of the increased investment of liquid funds from cash clearing with HGV. By contrast, cash and cash equivalents fell by € 17.4 million to € 177.2 million.

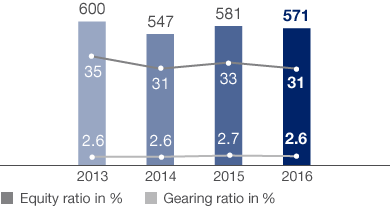

Developments in Group Equity

in € million

On the liabilities side, equity declined by € 9.8 million compared to year-end 2015 to stand at € 570.8 million (previous year: € 580.6 million). The decrease is primarily attributable to dividends distributed and the reclassification of a future financial settlement totalling € 67.4 million as a non-current financial liability. A change in actuarial gains and losses due to interest rate differentials, netted with deferred taxes, reduced equity by an additional € 30.8 million. Consolidated net income for the reporting period of € 105.1 million had a positive effect. The equity ratio decreased to 31.5 % (previous year: 33.2 %).

Non-current liabilities rose by € 48.9 million to € 1,028.1 million (previous year: € 979.2 million), This was mainly due to the interest-related increase in pension provisions of € 44.9 million. The € 35.7 million increase in non-current provisions to € 102.6 million (previous year: € 66.9 million) was largely offset by the € 32.2 million decrease in financial liabilities to € 339.2 million (previous year: € 371.4 million).

Current liabilities rose by € 23.4 million to € 214.0 million (previous year: € 190.6 million). This was primarily attributable to trade liabilities, which grew by € 16.1 million to € 68.1 million (previous year: € 52.0 million).

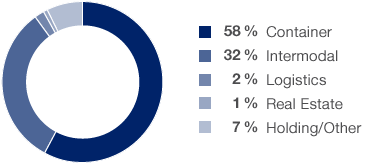

Investments

by segment in 2016

Investment Analysis

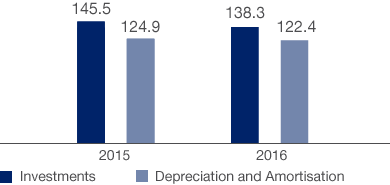

Capital expenditure in the past financial year totalled € 138.3 million (previous year: € 145.5 million). This figure includes additions of € 4.1 million from finance leases not recognised as a direct cash expense (previous year: € 3.8 million). In 2016, capital expenditure focused on extending the Hamburg container terminals and expanding intermodal transport and handling capacities. Investment projects were largely funded by the operating cash flow generated in the financial year.

Property, plant and equipment accounted for € 123.2 million (previous year: € 135.9 million) of capital expenditure, while intangible assets accounted for € 12.3 million (previous year: € 8.8 million) and investment property for € 2.8 million (previous year: € 0.8 million).

Investments amounting to € 81.3 million were made in the Container segment (previous year: € 61.0 million). Capital expenditure in this segment was dominated by the procurement of handling equipment, as well as storage capacities and throughput areas at the Hamburg container terminals. The Intermodal segment invested € 44.1 million (previous year: € 77.1 million). Investments were primarily made by the METRANS Group, and mainly in the construction of the Budapest inland terminal and the purchase of wagons. Capital expenditure in the Logistics segment came to € 2.4 million (previous year: € 2.8 million). The Holding/Other segment invested a total of € 10.3 million (previous year: € 6.4 million). Investment activities focused on the migration to a new terminal operating system.

Investments, Depreciation and Amortisation

in € million

Investments in the Container segment focus on enhancing the productivity of existing terminal areas by using state-of-the-art handling technology and developing berth places for the trend in ship sizes. The primary objective in the Intermodal segment is to increase the depth of value added to further improve the performance and range of its hinterland connections.

As of year-end, there were other financial liabilities for outstanding purchase commitments totalling € 56.8 million (previous year: € 134.4 million). This figure includes € 34.2 million (previous year: € 88.0 million) for the capitalisation of property, plant and equipment.

Liquidity Analysis

Cash flow from operating activities rose year-on-year from € 195.3 million to € 234.6 million. The increase of € 39.3 million is mainly attributable to higher provisions, which rose by € 34.4 million, the € 15.7 million increase in trade and other liabilities, the € 9.4 million decrease in income tax payments and the € 7.5 million year-on-year increase in EBIT. The € 36.2 million increase in trade receivables had an opposing effect.

Cash flow from investing activities (outflow) of € 48.9 million, was down on the prior-year figure of € 130.2 million. This € 81.3 million decline in cash outflows was mainly the result of higher proceeds from short-term deposits in the amount of € 54.3 million (previous year: € 17.0 million). At the same time, payments for investments in property, plant and equipment and investment property declined from € 150.8 million in the previous year to € 117.9 million in the reporting period.

in € million |

2016 |

2015 |

||

Financial funds as of 01.01. |

165.4 |

185.6 |

||

Cash flow from operating activities |

234.6 |

195.3 |

||

Cash flow from investing activities |

- 48.9 |

- 130.2 |

||

Free cash flow |

185.7 |

65.1 |

||

Cash flow from financing activities |

- 122.4 |

- 82.7 |

||

Change in financial funds |

63.2 |

- 17.6 |

||

Change in financial funds due to exchange rates |

- 1.0 |

- 2.6 |

||

Change in financial funds due to consolidation |

4.8 |

0 |

||

Financial funds as of 31.12. |

232.4 |

165.4 |

||

Short-term deposits |

18.8 |

73.1 |

||

Available liquidity |

251.2 |

238.5 |

Free cash flow – the total cash flow from operating and investing activities – increased to € 185.6 million (previous year: € 65.1 million).

Cash flow from financing activities (outflow) amounted to € 122.4 million in the reporting period (previous year: € 82.7 million), down € 39.7 million below the prior-year figure. In addition to the acquisition of non-controlling interests, the net result of a decline in new borrowing and lower principal repayments on loans led to an increase in net cash outflow from financing activities.

The HHLA Group had sufficient liquidity as of 2016 year-end. There were no liquidity bottlenecks in the course of the financial year. Financial funds totalled € 232.4 million as of 31 December 2016 (31 December 2015: € 165.4 million). Including all short-term deposits, the Group’s available liquidity as of the 2016 year-end came to a total of € 251.2 million (previous year: € 238.5 million).

Financing Analysis

Financial management at the HHLA Group is managed centrally and serves the overriding objective of ensuring the Group’s long-term financial stability and flexibility. Group clearing pools the Group’s financial resources, optimises net interest income and substantially reduces dependency on external sources of funding. Derivative financial instruments can be used to reduce the risk of changes in interest rates and, to a minor extent, to reduce currency and commodity price risks.

HHLA’s business model is dominated by a large proportion of property, plant and equipment with long useful lives. For this reason, HHLA mainly uses medium and long-term loans and finance leases to achieve funding with matching maturities. Pension provisions are also available for long-term internal financing.

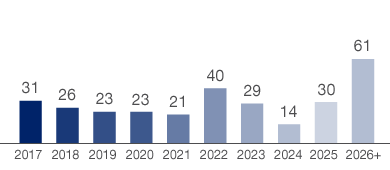

At € 298.4 million as of the balance sheet date, amounts due to banks were below the prior-year figure of € 329.6 million. The Group drew on additional external financing totalling € 10.0 million (previous year: € 121.3 million). New borrowing was offset by loan repayments amounting to € 42.8 million (previous year: € 59.0 million). In the previous year, a promissory note loan was used to replace a shareholder loan. Due to the maturities agreed and its stable liquidity position, the company had no significant funding requirements.

Maturities of Bank Loans

by year and in € million

The majority of the liabilities from loans are denominated in euros, with a small proportion in US dollars. In terms of conditions, approximately 58 % have fixed interest rates and some 42 % have floating interest rates. As a result of borrowing, certain affiliated companies had covenants linked to key balance sheet figures, which mostly require a minimum equity ratio to be met. Covenants are currently in place for around 22 % of bank loans. These covenants were met at all agreed audit points throughout the reporting year. As of the balance sheet date, HHLA disclosed non-current liabilities to related parties totalling € 105.9 million (previous year: € 106.3 million). These resulted from the recognition of the leasing liability to the Hamburg Port Authority (HPA) in connection with quay walls for the mega-ship berths at the HHLA Container Terminal Burchardkai (CTB) and the HHLA Container Terminal Tollerort (CTT).

With the exception of operating leases, there are no significant off-balance sheet financial instruments. These operating leases relate primarily to long-term agreements between the HHLA Group and either the Free and Hanseatic City of Hamburg or the HPA for leasing land and quay walls in the Port of Hamburg and the Speicherstadt historical warehouse district.

Cash, cash equivalents and short-term deposits, the bulk of which is held centrally by the holding company, totalled € 177.2 million (previous year: € 194.6 million). These funds are mainly invested at German financial institutions with verified high credit ratings as demand deposits, call money and short-term deposits. Current credit lines play a subordinate role due to HHLA having sufficient liquid funds. As of the balance sheet date, the Group had unused credit facilities amounting to some € 0.2 million (previous year: € 1.2 million). The credit line utilisation rate was 96.8 % in the period under review (previous year: 83.9 %). In HHLA’s view, the Group’s solid balance sheet structure would enable more substantial credit facilities to be arranged at any time if its medium-term liquidity planning were to reveal a need. Of the total cash and cash equivalents, € 16.2 million (previous year: € 10.7 million) was subject to restrictions in Ukraine relating to the transfer of currency abroad as of the reporting date.

As HHLA has a large number of borrowing options at its disposal outside of the capital market, the Group currently sees no need for an external rating. Instead, it provides existing and potential creditors with comprehensive information to ensure that they can derive appropriate internal credit ratings.

Public subsidies awarded for individual development projects that are subject to specific conditions are of minor importance in terms of their volume at Group level.

Acquisitions and Disposals of Companies

HHLA increased its interest in METRANS a.s., Prague, Czech Republic, from 86.5 % to 90.0 % with the share purchase and transfer contracts dated 28 June 2016 after METRANS a.s. acquired treasury shares from its non-controlling interests. The purchase price for these shares was taken directly to equity in accordance with the entity concept with a corresponding reduction in non-controlling interests and retained earnings.

Changes in the Group of Consolidated Companies

METRANS Danubia Krems GmbH, Krems an der Donau, Austria, and METRANS Railprofi Austria GmbH, Krems an der Donau, Austria, were fully consolidated and included in HHLA’s Consolidated Financial Statements for the first time as of 31 March 2016. As of 30 June 2016, METRANS Adria D.O.O., Koper, Slovenia, METRANS Danubia Kft., Gyor, Hungary, and METRANS ISTANBUL STI, Istanbul, Turkey, were fully consolidated for the first time and DHU Gesellschaft Datenverarbeitung Hamburger Umschlagsbetriebe mbH, Hamburg, was included in HHLA’s Consolidated Financial Statements for the first time using the equity method. HHLA International GmbH, Hamburg, was fully consolidated for the first time as of 30 September 2016. Univer Trans Kft., Budapest, Hungary, was fully consolidated and included in HHLA’s Consolidated Financial Statements for the first time as of 31 December 2016.

The effects of initial consolidation on HHLA’s Consolidated Financial Statements were recognised directly in equity and were immaterial.

HHLA Intermodal Polska Sp. z o.o., Warsaw, Poland, was merged with POLZUG Intermodal Polska Sp. z o.o., Warsaw, Poland, in June 2016. The merger had no effect on HHLA’s Consolidated Financial Statements.

There were no other acquisitions, purchases or disposals of shares in subsidiaries, or changes to the group of consolidated companies. see also Note 3 of the Notes to the Consolidated Financial Statements

Payments for investments in property, plant and equipment, investment property and intangible assets.

Equity / balance sheet total.

In maritime logistics, a terminal is a facility where freight transported by various modes of transport is handled.

Transportation via several modes of transport (water, rail, road) combining the specific advantages of the respective carriers.

According to literature on IFRS key figures: EBIT – taxes + depreciation and amortisation – write-backs +/– changes in non-current provisions (excl. interest portion) +/– gain/loss on the disposal of property, plant and equipment + changes in working capital.

Payments for investments in property, plant and equipment, investment property and intangible assets.

In maritime logistics, a terminal is a facility where freight transported by various modes of transport is handled.

Production value – intermediate inputs (cost of materials, depreciation and amortisation, and other operating expenses); the value added generated is shared between the HHLA Group’s stakeholders, such as employees, shareholders, lenders and the local community.

A port’s catchment area.

Earnings before interest and taxes.

Financial instruments traditionally used to hedge existing investments or obligations.

Transportation via several modes of transport (water, rail, road) combining the specific advantages of the respective carriers.