The HHLA Share

in €, Class A shares, Xetra |

2017 |

2016 |

||||

|

||||||

Closing price |

23.67 |

17.70 |

||||

Performance in % |

33.7 |

25.9 |

||||

Highest price |

28.23 |

17.88 |

||||

Lowest price |

16.80 |

11.95 |

||||

Average daily trading volume |

117,313 |

43,143 |

||||

Dividend per Class A share1 |

0.67 |

0.59 |

||||

Dividend yield as of 31.12. in % |

2.8 |

3.3 |

||||

Number of listed Class A shares in thousand |

70,048.8 |

70,048.8 |

||||

Market capitalisation as of 31.12. in € million |

1,658.1 |

1,239.9 |

||||

Price-earnings-ratio as of 31.12. |

23.2 |

19.5 |

||||

Earnings per share |

1.02 |

0.91 |

||||

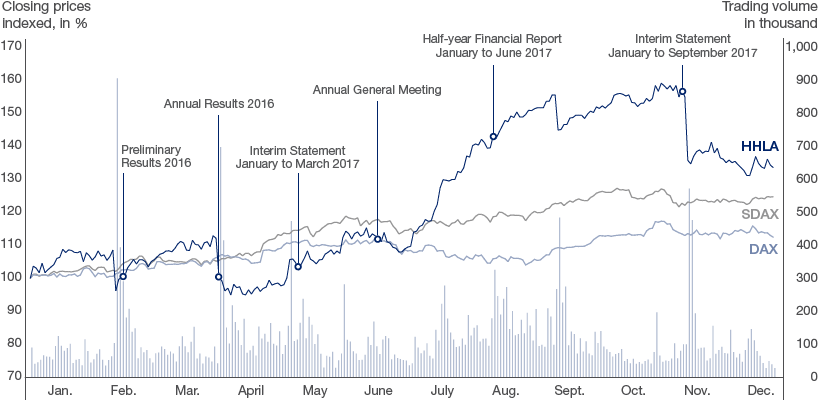

Stock Markets Up in 2017 with Strong Year-End

Germany’s leading index put in a strong performance over the course of the year. Driven by the positive economic trend, the DAX achieved significant growth in 2017 against a backdrop of low interest rates. At the beginning of the year, the leading indices continued the upward trend of late 2016 and got off to a strong start. In the first quarter, share prices were particularly affected by changing expectations for the US economy, which fluctuated between optimism and political concern. However, the leading indices were kept on track by strong economic data, a weak euro and healthy earnings reported by German companies. As a result, the DAX closed the quarter just short of its all-time high. The markets were sluggish in April. Only after Macron’s victory in the French elections did the DAX start a record recovery, briefly interrupted by the Russia scandal in mid-May with alleged contact between US President Trump and the Russian government. This resulted in a brief consolidation phase in the second half of May. Nevertheless, the DAX began to approach the 13,000 mark in mid-June. This upswing was tempered, however, by falling oil prices. Further gains for the leading indices were also prevented by speculation about a possible tightening of monetary policy by the European Central Bank. In the subsequent summer months, the strong euro remained a burden on the benchmark indices. The escalating conflict between the USA and North Korea in late August unsettled the capital markets further. It took until the beginning of the fourth quarter for the DAX to break out of its sideways trend and record modest growth again. The general election in Germany on 24 September had little impact on market sentiment. It was not until the European Central Bank announced plans to reduce its monthly bond purchases in late October that the DAX gained further momentum. As a result, Germany’s leading index reached its all-time high of 13,479 points on 3 November. However, the DAX was unable to establish itself permanently above the 13,000 mark and remained volatile around this level. Germany’s stock markets were only briefly impacted by the failure to form a new government and the announcement of US tax reforms. The DAX was thus ultimately unable to maintain 13,000 points and closed the year at 12,918. This corresponds to a year-on-year increase of 12.5 % – a strong performance that was doubled by the SDAX, which grew by 24.9 % in the course of the year. The small cap index finished at 11,887 points.

Share Price Development 2017

Source: Datastream

HHLA Share Price Rises by Approximately 34 %

The HHLA share got off to a very strong start in 2017 and was able to outperform the leading indices until 9 February, when the Federal Administrative Court announced its decision regarding dredging of the river Elbe. Following the announcement, the share price dropped by 15 % for a period as a number of strongly differing interpretations circulated on the market. Once the verdict had been clarified – a decision in favour of dredging the river under certain conditions – the share rallied and finished the quarter just under the € 20 mark. After the figures for 2016 were published on 30 March, including guidance for the 2017 financial year, the share price dropped by more than 10 % in one day. Considering the positive results achieved in 2016, the capital markets had expected a more bullish forecast and were therefore hesitant. In April, the share stabilised around € 17 and remained in line with the markets. It picked up in early May with the improved outlook for volume and earnings in the Container segment for 2017, following successful negotiations with the shipping companies. Buoyed by the positive results of the first quarter, published in the Interim Statement on 12 May, the share price gathered momentum and passed the € 20 mark for the first time in early June. Following the dividend payment adopted by the Annual General Meeting on 21 June 2017, the share traded at a corresponding discount. At the end of the first half-year, positive throughput data from Asia and technical indicators in chart analyses strengthened the share’s dynamic upward trend. The positive guidance update for 2017 published with the first-half results in mid-August lifted the share price above the € 25 mark, where it remained. The share had last traded at this price in March 2012. In the second half of August, various analysts raised their upside targets and helped fuel market demand. However, a sell recommendation in mid-September led to a noticeable fall in the share price. By the beginning of October, however, it had recovered again and stabilised at around € 27. In the run-up to the publication of the nine-month results on 14 November, the share price picked up again and passed the € 28 mark in early November. HHLA confirmed its guidance for the financial year. The sell recommendation of one financial analyst on 16 November led to profit-taking by numerous investors and prompted a 10 % decline. The share price subsequently stabilised at around € 24. In view of the outstanding hearings for appeals against the dredging of the river Elbe, the capital market remained cautious. Once the Federal Administrative Court had dismissed the last appeals against the dredging of the river Elbe on 18 December, the HHLA share soared to a month-high of € 24.27. It closed the year at € 23.67. Over the year as a whole therefore, the HHLA share price was up by 33.7 % in total.

Type of shares |

No-par-value registered shares |

|

ISIN / SIC |

DE000A0S8488 / A0S848 |

|

Symbol |

HHFA |

|

Stock exchanges |

Frankfurt am Main, Hamburg |

|

Segment |

Prime Standard |

|

Sector |

Transport & Logistics |

|

Index affiliation |

SDAX |

|

Ticker symbol Bloomberg / Reuters |

HHFA:GR / HHFGn.de |

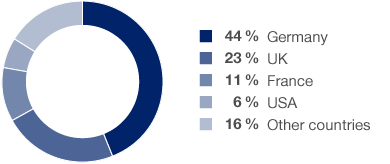

Shareholder Base Still Widely Spread

HHLA’s shareholder base remained largely stable in 2017. In terms of the listed Class A shares, the Free and Hanseatic City of Hamburg remained the company’s largest shareholder with an unchanged stake of 68.4 %. The free float portion amounted to 31.6 %. According to the voting rights notifications submitted to HHLA as of the end of 2017, no single investor held more than 3 % of the remaining free float shares at this time. In the course of the year, the US investor First Eagle Investment Management fell below the 5 % reporting threshold in mid-August and below the 3 % reporting threshold in October. Among daily traded shares, ownership shifted slightly in favour of institutional investors. They continued to hold the majority of free floating shares at year-end, accounting for 22.9 % of all shares (previous year: 22.2 %). Meanwhile, 8.0 % of share capital was held by private investors (previous year: 8.7 %). Overall, HHLA’s share capital remained widely distributed among some 26,000 registered shareholders. In regional terms, the largest free float shareholders were based primarily in Germany, the USA, the UK and other countries in continental Europe.

Dialogue with Capital Market Maintained

Rapid reaction times, an ability to provide comprehensive information and an open dialogue with financial analysts and investors remained key to HHLA’s investor relations (IR) activities in 2017, given the persistently volatile industry environment. In order to serve the needs of both institutional and private investors, HHLA attended a number of investor conferences as well as the “Börsentag Hamburg” stock exchange event. These initiatives were supplemented by roadshows in major European cities. Investors were also invited to a large number of meetings at the company’s headquarters in Hamburg. There was considerable interest in the opportunities offered for discussion. Furthermore, the Executive Board provided details on business developments during quarterly conference calls. For the first time, the Executive Board invited financial analysts to a capital market day at the hinterland terminal in Prague in mid-November to report in depth on developments in the Intermodal segment.

Coverage of IR Activities

Contact with Investors by Region in 2017

With its proactive approach to communications, the Investor Relations department maintains a close dialogue with shareholders and potential investors. In addition to informing interested members of the public, the team also responds to issues of particular relevance to investors. In the 2017 financial year, HHLA’s investors showed a keen interest in the verdict on the dredging of the river Elbe and the current status of the supplementary planning order. The formation of new shipping alliances and the consequences for both capacity utilisation at HHLA and the company’s negotiating position were also discussed at length. Volumes at Hamburg Süd following its takeover by the shipping company Maersk also proved to be a key topic for the capital market in the second half of the year.

HHLA has been offering a full HTML version of its Annual Report in addition to existing services such as the IR website and Twitter updates since 2016. The switch from print to online enables all stakeholders to navigate information interactively, search for content in a targeted manner and compile this information as desired.

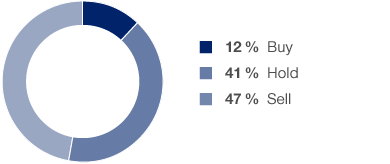

HHLA Share Still of Interest for Analysts

Recommendations by Financial Analysts

as of 31.12.2017

HHLA places great value on broad and well-informed coverage of its share by financial analysts as this enhances investors’ understanding of the company’s business model and ensures a comprehensive range of sentiments. HHLA therefore remains in close contact with all financial analysts and constantly strives to expand the number of independent studies conducted.

As in the previous year, a total of 17 financial analysts covered HHLA’s business development and issued reports and recommendations concerning the share. This means that the HHLA share has above-average coverage for an SDAX company. More than half of the analysts recommend buying or holding the share. They particularly emphasise the successful Intermodal business and growth potential resulting from the forthcoming dredging of the navigation channel. Meanwhile, following the share’s strong performance in the past year, analysts with sell recommendations primarily highlight the risks arising from the as yet uncompleted dredging of the river Elbe, limited cost flexibility and increasingly fierce competition among the North Range ports.

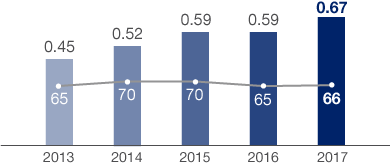

Higher Dividend Proposal

Development of Dividend and Payout Ratio

per Listed Class A Share in € / Payout Ratio in %

2017: Dividend proposal

The tenth Annual General Meeting since HHLA’s initial public offering was held in Hamburg on 21 June 2017. Around 850 shareholders or 83 % of the nominal capital were represented (previous year: 84 %). The resolutions proposed by the Supervisory Board and the Executive Board were all adopted by the shareholders present with large majorities. These included a motion to distribute a dividend of € 0.59 per entitled share of the listed Port Logistics subgroup (Class A share). HHLA thus distributed dividends totalling € 41.3 million, as in the previous year. This corresponded to a payout ratio of approximately 65 % of the Port Logistics subgroup’s net profit after minority interests for the year. The dividends were paid out to the shareholders on 26 June 2017. Based on its closing price of € 22.99 on the day of the Annual General Meeting, the HHLA share achieved a dividend yield of 2.6 %, putting it in the top 15 of the SDAX.

On the basis of the earnings achieved in 2017, the Executive Board and Supervisory Board will propose a dividend of € 0.67 per Class A share at the Annual General Meeting to be held on 12 June 2018. A total of € 46.9 million would therefore be distributed (previous year: € 41.3 million). In an external comparison, the payout ratio would remain high at 66 %. HHLA would therefore continue to pursue its dividend policy of distributing between 50 and 70 % of the Port Logistics subgroup’s relevant net profit for the year to its shareholders.

Payments for investments in property, plant and equipment, investment property and intangible assets.

A port’s catchment area.

In maritime logistics, a terminal is a facility where freight transported by various modes of transport is handled.

Transportation via several modes of transport (water, rail, road) combining the specific advantages of the respective carriers.

The North European coast. In the broadest geographic sense, this is where all the international ports in Northern Europe from Le Havre to Hamburg can be found. The four largest ports are Hamburg, Bremerhaven, Rotterdam and Antwerp.