The HHLA Share

31.12.2016 – 30.06.2017 |

HHLA |

SDAX |

DAX |

|||

Change |

8.0 % |

13.9 % |

7.4 % |

|||

Closing 31.12.2016 |

17.70 |

9,519 |

11,481 |

|||

Closing 30.06.2017 |

19.12 |

10,847 |

12,325 |

|||

High |

20.42 |

11,323 |

12,889 |

|||

Low |

16.80 |

9,519 |

11,481 |

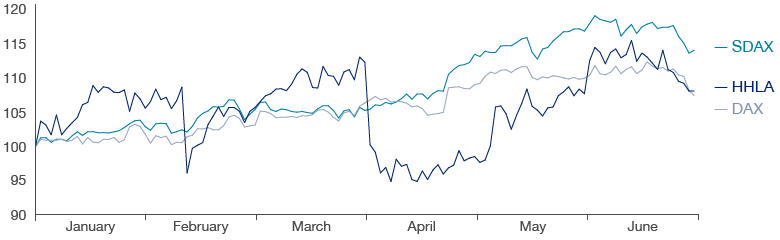

Leading Indices at Record Level

Leading indices were able to continue the positive trend seen at the end of 2016 through to the new year, getting off to a modestly favourable start in 2017. In the first quarter, share prices were particularly affected by shifting expectations for the US economy, fluctuating between optimism and political concern. Strong economic data, a weak euro and a solid reporting period in Germany all buoyed the leading indices, with the DAX closing just short of its all-time high at the end of the quarter. Compared with the end of 2016, Germany’s leading index gained 7.2 % and the SDAX 6.0 % as of 31 March. The markets were sluggish in April. Only after Macron’s victory in the French elections did the DAX start a record recovery, briefly interrupted by the Russia scandal mid-May, where contact between US President Trump and the Russian government was alleged. This resulted in a brief consolidation phase in the second half of May. Regardless, the DAX climbed to an all-time high by 19 June of 12,889 points. In the last third of the month, falling oil prices tempered the upswing. The prospect of tighter monetary policies from the European Central Bank also stood in the way of further gains for the leading indices. Nevertheless, the DAX closed the first six months with 12,325 points and gained 7.4 % compared to 31 December 2016. The SDAX was able to outperform this solid gain and closed with 10,847 points on 30 June, up 13.9 % compared with the end of 2016.

HHLA Share Strong

The HHLA share got off to a strong start in 2017 and was able to outperform the leading indices until 9 February, when the Federal Administrative Court announced its decision regarding the dredging of the river Elbe. Following the announcement, the share price dropped by 15 % for a period as a number of interpretations circulated on the market. Once the decision was clarified – a positive decision for dredging the river, with conditions – the share rallied and closed at € 19.98 on 28 March. After the figures for 2016 were published on 30 March, including the forecast for 2017, the share price dropped by more than 10 % in one day. Considering the positive results achieved in 2016, the capital markets had expected a more bullish forecast and were therefore hesitant. In April, the share stabilised around € 17 and remained in line with the markets. It only picked up with the improved outlook for volume and earnings in the Container segment in 2017, released on 5 May. Buoyed by the positive results of the first quarter, published in the Interim Statement on 12 May, the share price once again climbed over the € 19 mark and at the end of the month regained the momentum seen on the leading indices. At the beginning of June, the HHLA share exceeded the € 20 mark for the first time in its history and closed on 14 June 2017 at a new year-high of € 20.42. HHLA’s Annual General Meeting took place the following week on 21 June 2017 and was attended by around 850 shareholders and guests. Approximately 83 % of share capital was represented. The resolutions proposed by the Supervisory Board and Executive Board were adopted with large majorities, including the payment of a dividend of € 0.59 per listed Class A share, as in the previous year. Following payment the share traded at a corresponding discount and closed 30 June at € 19.12. The share therefore gained 8.0 % in the first half of the year.

Dialogue with Capital Market Actively Maintained

The Investor Relations department continued its proactive communication activities in the first half of 2017 and held a large number of discussions with analysts and investors. HHLA was also represented at a number of capital market conferences in Europe. Discussions centred around interpretations of the decision by the Federal Administrative Court and the results of contract negotiations following the reorganisation of shipping consortia and the consequences for HHLA.

For an SDAX share, coverage of the HHLA share remains high. The HHLA share is currently covered by 17 financial analysts. Around half recommend holding the HHLA share, while approximately a quarter recommend buy, and the other quarter sell.

Share Price Development January to June 2017

Closing prices in %

Source: Datastream

The latest prices and further information about HHLA’s shares can be found at www.hhla.de/investor-relations.