The HHLA Share

|

29.12.2017 – 29.06.2018 |

HHLA |

SDAX |

DAX |

|||

|

Change |

- 21.4 % |

0.5 % |

- 4.7 % |

|||

|

Closing 29.12.2017 |

23.67 |

11,887 |

12,918 |

|||

|

Closing 29.06.2018 |

18.60 |

11,950 |

12,306 |

|||

|

High |

24.36 |

12,737 |

13,560 |

|||

|

Low |

17.67 |

11,602 |

11,787 |

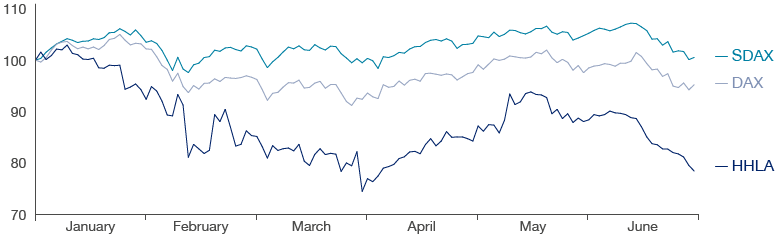

Benchmark indices burdened by strong euro and punitive US tariffs

Germany’s benchmark index made a sluggish start to 2018 on account of the strong euro. In anticipation of a strong reporting period, the DAX climbed to a new all-time high of 13,560 points in the second half of January. In February, however, fears of rising interest rates resulting from a tighter monetary policy of the US Federal Reserve had a negative effect on stock markets. The subsequent slump on the US stock markets also entailed losses on their European counterparts. The DAX fell to a new low for the year of 12,107 points on 9 February 2018 and, with a decline of over 5 %, recorded its largest weekly loss in two years. US President Donald Trump’s announcement of punitive tariffs on steel and aluminium imports pushed the DAX below the 12,000 mark in March and caused considerable uncertainty on the market, with this uncertainty only easing a little in early April. Driven by positive indications from the USA and China, Germany’s benchmark index rose again and, in mid-May, reached the level obtained at the start of the year. In June, European stock trading was once again overshadowed by the expansion of the trade dispute. The decision of the European Central Bank to leave the base rate unchanged only brought short-term relief. The DAX closed the second quarter at 12,306 points, down 4.7 % on the year-end 2017 figure. The SDAX was somewhat less volatile, closing at 11,950 points on 29 June – up 0.5 % on year-end 2017.

HHLA share down in declining market

The HHLA share made a positive start to the new year, reaching its year-high so far of € 23.36 on 9 January. From mid-January onwards, however, the share weakened in a declining market environment before stabilising at over € 22. A number of recommendations for the share were upgraded on publication of HHLA’s interim figures on 8 February. Nevertheless, the share price was burdened by the negative market trend. Once it fell below the € 20 mark on the following day, the pressure on the order book intensified. The daily trading volume climbed to 346 thousand shares, almost quadruple the annual average; the share price fell further. In addition to the technical downwards trend, the HHLA share was affected in particular by concerns surrounding the consequences of a potential trade war. Prior to the publication of the 2017 Annual Report on 28 March 2018, the share price fell to a year-low so far of € 17.67. The share price rose steadily throughout April, once again exceeding the € 20 mark towards the end of the month. Following the buy recommendation of a bank in early May, the share price rose strongly by 9.6 % over the day. The market outlook for the first quarter was confirmed with the publication of the quarterly figures on 15 May 2018. In particular, the strategic measures were received favourably by the market. HHLA’s Annual General Meeting was held on 12 June 2018 and attended by just under 670 shareholders and guests. Approximately 82 % of share capital was represented. The resolutions proposed by the Supervisory Board and Executive Board were adopted with large majorities, including the payment of a dividend of € 0.67 (previous year: € 0.59) per listed Class A share. Following payment, the share traded at a corresponding discount. In the second half of June, the HHLA share also began to feel the effects of the strained market environment. It once again dropped below the € 20 mark and closed at € 18.60 on 29 June, down 21.4 % compared to year-end 2017.

Dialogue with capital market actively maintained

The Investor Relations department continued its proactive communication activities in the first half of 2018 and held a large number of discussions with analysts and investors. HHLA was also represented at various conferences in Europe and the USA. In addition to the strategic realignment and associated investment programme, discussions focused in particular on the Intermodal segment. Furthermore, the acquisition of the Estonian multi-functional terminal Transiidikeskuse AS and the current status of dredging on the Elbe were also elucidated. In the first half of the year, 15 financial analysts covered the HHLA share, meaning that the level of research coverage remained high for an SDAX share. More than three quarters of the analysts recommend buying or holding the HHLA share.

Share Price Development January to June 2018

Closing prices in %

Source: Datastream

The latest prices and further information about HHLA’s shares can be found at www.hhla.de/en/investor-relations.html.