Customer Structure and Sales

The customer base in the Container and Intermodal segments consists mainly of shipping companies and freight forwarders. The services provided in the Logistics segment are aimed at various customer groups, ranging from steel companies and power stations (in the field of bulk cargo handling) to international operators of ports and other logistics centres (in the field of port consulting). The Real Estate segment lets its office space and commercial premises to German and international customers from a variety of sectors, ranging from logistics and trading companies to media, consulting and advertising agencies, fashion labels, hotels and restaurants, and companies from the creative industries.

Globally operating container shipping companies account for the largest share of HHLA’s revenue. In ship handling, HHLA’s container terminals work with shipping companies on a neutral basis (multi-user principle) and offer a wide range of high-quality services. Due to the wave of consolidation in the container shipping segment, HHLA’s customer base changed again in 2017. Hapag-Lloyd completed its purchase of the Middle Eastern UASC in May. However, most of the effects of this deal will only be felt in the course of 2018. The takeover of the Hamburg-based shipping company Hamburg Süd by Denmark’s Maersk Line, already announced in December 2016, was finalised in late 2017. In addition, the planned purchase of OOCL by the Chinese line COSCO Shipping is currently being examined by the anti-trust authorities. The merger of three Japanese shipping companies – NYK Line, MOL and K Line – to create Ocean Network Express (ONE for short) was approved by the anti-trust authorities. The new company is due to start operating in April 2018. In the reporting year, HHLA’s customer base included all of the world’s top 15 container shipping companies. HHLA therefore believes it is well placed to also meet the future requirements of its clients in the shipping sector. see also Business Forecast

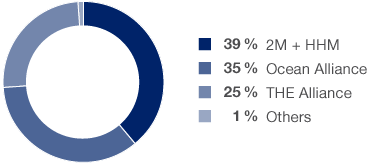

Mergers in container shipping have reduced the number of large shipping line alliances from four to three.

by carrying capacity as of 31 December 2017 |

||||||||

|

Shipping company |

Alliance 2017 |

in thousand TEU |

|||||

|

||||||||

1. |

APM-Maersk |

2M |

4,152 |

|||||

2. |

MSC |

2M |

3,148 |

|||||

3. |

CMA CGM Group |

Ocean Alliance |

2,514 |

|||||

4. |

COSCO Shipping |

Ocean Alliance |

1,801 |

|||||

5. |

Hapag-Lloyd (incl. UASC) |

THE Alliance |

1,548 |

|||||

6. |

Evergreen |

Ocean Alliance |

1,060 |

|||||

7. |

OOCL |

Ocean Alliance |

689 |

|||||

8. |

Yang Ming |

THE Alliance |

595 |

|||||

9. |

MOL |

THE Alliance |

584 |

|||||

10. |

NYK Line |

THE Alliance |

558 |

|||||

11. |

PIL |

– |

385 |

|||||

12. |

Zim |

– |

366 |

|||||

13. |

Hyundai M.M. |

2M - associated |

347 |

|||||

14. |

K Line |

THE Alliance |

341 |

|||||

15. |

Wan Hai |

– |

236 |

|||||

Sales activities in the Container segment are organised by means of key account management. In the Intermodal and Logistics segments, sales are generally managed locally by the individual companies. As far as possible, all activities follow the strategic approach of vertical integration, i.e. offering comprehensive transport and logistics services from a single source. The Real Estate segment’s sales team offers potential clients and tenants a wide range of services for properties in its two main districts – Hamburg’s Speicherstadt historical warehouse district and the northern banks of the river Elbe/fish market area – as well as for logistics properties in and around the port.

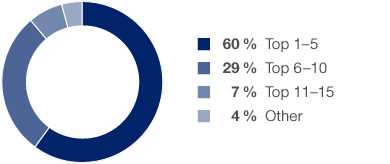

Revenue Distribution Split by Customers

in the Container segment at the main hub of Hamburg in 2017

Capacity Breakdown by Shipping Line Alliances

on Far East–Europe services as of 31 December 2017

Source: Alphaliner Monthly Monitor, January 2018

The share of revenue attributable to HHLA’s five most important customers in the Container segment rose again in the 2017 financial year, taking it to 60 % (previous year: 57 %). The ten most important customers accounted for 89 % of revenue (previous year: 82 %) generated by HHLA’s container terminals in Hamburg – up markedly on the previous year’s figure due to the wave of consolidation. Meanwhile, the figure for the 15 most important customers edged up to 96 % (previous year: 94 %). HHLA has maintained commercial relationships with the majority of its most important customers for well over two decades.

HHLA concludes framework contracts with its shipping customers that set out both the scope and remuneration of services. As the usage volume for these services is not fixed, there is no order backlog in the traditional sense for the specific services provided by HHLA.

Revenue from sales or lettings and from services rendered, less sales deductions and VAT.

In maritime logistics, a terminal is a facility where freight transported by various modes of transport is handled.

Transportation via several modes of transport (water, rail, road) combining the specific advantages of the respective carriers.